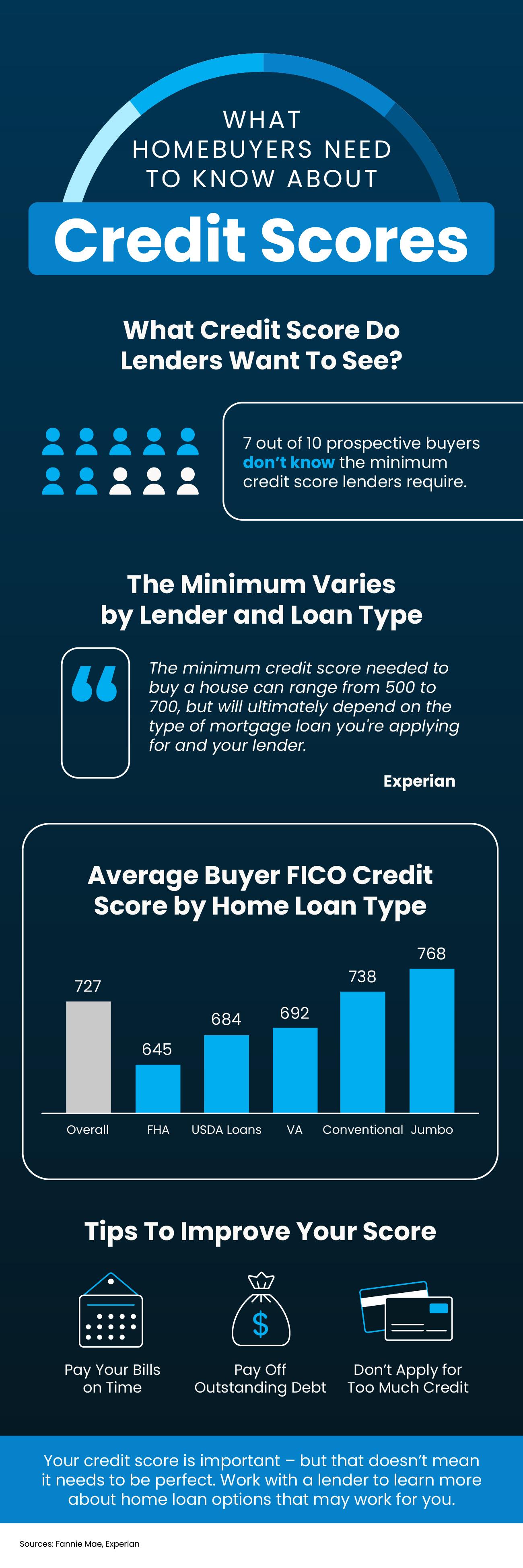

What Homebuyers Need To Know About Credit Scores

Some Highlights

- Data shows 7 out of 10 prospective homebuyers don’t know the minimum credit score required by lenders or that it varies by lender and loan type.

- According to Experian, the range is anywhere from 500 to 700 for the minimum credit score. That means you don’t need perfect credit to buy a home.

- Your credit score is important – but that doesn’t mean it needs to be perfect. Work with a lender to learn more about home loan options that may work for you.

Categories

Recent Posts

Struggling To Sell Your House? Read This.

The Biggest Perks of Buying a Home This Winter

More Starter Homes Are Hitting the Market

Only an Expert Agent Can Give You an Accurate Value of Your Home

What Homebuyers Need To Know About Credit Scores

The Top 2 Reasons To Look at Newly Built Homes

Why Moving to a More Affordable Area Makes Sense

What Will It Take for Prices To Come Down?

Why More Sellers Are Hiring Real Estate Agents

Why This Winter Is the Sweet Spot for Selling

Whether you're trying to buy your dream home or selling your current one, LPT Realty's number one priority is to help find you the best deal possible while providing exceptional customer service. LPT Realty agents are armed with best in class technology and marketing tools to help you make informed decisions about buying or selling your home, and are there for you every step of the way.